Simplified Sign-Up for Generous for Church. Platform: Generous for Church Live Date: August 1 2019 Module(s): Mobile App, Text-to-Give Generous has now updated its mobile and text-to-give sign-up procedure to make the process of giving for first-time users even quicker. Simplifying Sign Up. The purpose of every sign up form is to get users to complete it successfully and send it in. However, when users have to fill out a long and complicated sign up form, it can turn their excitement for your website into displeasure. Here are a few innovative techniques that'll make your forms faster and easier to fill out. Direct Recruitment Platform - Job Advertising, Employer Branding, Social Media, Programmatic, Applicant Tracking, Careers Portals, Job Boards. New AS online Sign-up-Process guide. Simplified process Launch - AS to PC conversion Simplified process launch - New Associate online Signup. This process can take months. For Johnson, the entire process lasted 94 days, from first congressional action to Senate acquittal, lasted from February 22, 1868 to May 26, 1868. For Richard Nixon. Happy wheelsobey games online.

The CRA recently introduced a simplified process to allow employees in certain cases to claim home office expenses. About 1/2 of charities in Canada have employees so this will be helpful for them. Also, many volunteers have day jobs and will benefit from this. In short, this simplified procedure will only apply to employees that worked from home at least 50% of the time over a period of 4 consecutive weeks in 2020, it is capped at $400 maximum and it provides $2 deduction for each day the employee worked from home. There is still available the 'detailed' method which may be better for some employees where the employer signs a form.

Here is the announcement that we received from CRA below.

Cue 16 reflections meaning. CUE 16 Reflections. 3/30/2016 0 Comments Ok, I'm going to attempt to finish my reflections from the CUE 16 Palm Springs Convention. This is not easy you see because.

| English version *** La version française suit *** Introducing a simplified process for claiming the home office expenses for Canadians working from home due to the COVID-19 pandemic This year has been filled with unprecedented challenges due to the COVID-19 pandemic. Many Canadians unexpectedly had to work from home which resulted in millions of Canadians setting up their work space in their kitchens, bedrooms and living rooms. In response, the Honourable Diane Lebouthillier, Minister of National Revenue, provided today additional details on how the Canada Revenue Agency (CRA) has made the home office expenses deduction available to more Canadians, and simplified the way employees can claim these expenses on their personal income tax return for the 2020 tax year. Employees with larger claims for home office expenses can still choose to use the existing detailed method to calculate their home office expenses deduction. Employees who worked from home more than 50% of the time over a period of a least four consecutive weeks in 2020 due to COVID-19 will now be eligible to claim the home office expenses deduction for 2020. The use of a shorter qualifying period will ensure that more employees can claim the deduction than would otherwise have been possible under longstanding practice. A new temporary flat rate method will allow eligible employees to claim a deduction of $2 for each day they worked at home in that period, plus any other days they worked from home in 2020 due to COVID-19 up to a maximum of $400. Under this new method, employees will not have to get Form T2200 or Form T2200S completed and signed by their employer. To simplify the process for employees choosing the detailed method, the CRA launched today simplified forms (Form T2200S and Form T777S) and a calculator designed specifically to assist with the calculation of eligible home office expenses. For more information on working from home expenses go to Canada.ca/cra-home-workspace-expenses. Quick Facts

Associated Links Stay connected Balloon in a wastelandspiter games. To receive updates on what is new at the Canada Revenue Agency (CRA), you can:

· Follow the CRA on Twitter – @CanRevAgency. · Follow the CRA on LinkedIn. · Subscribe to a CRA electronic mailing list. · Add our RSS feeds to your feed reader. · Watch our tax-related videos on YouTube. |

Simplified Sign-Up for Generous for Church

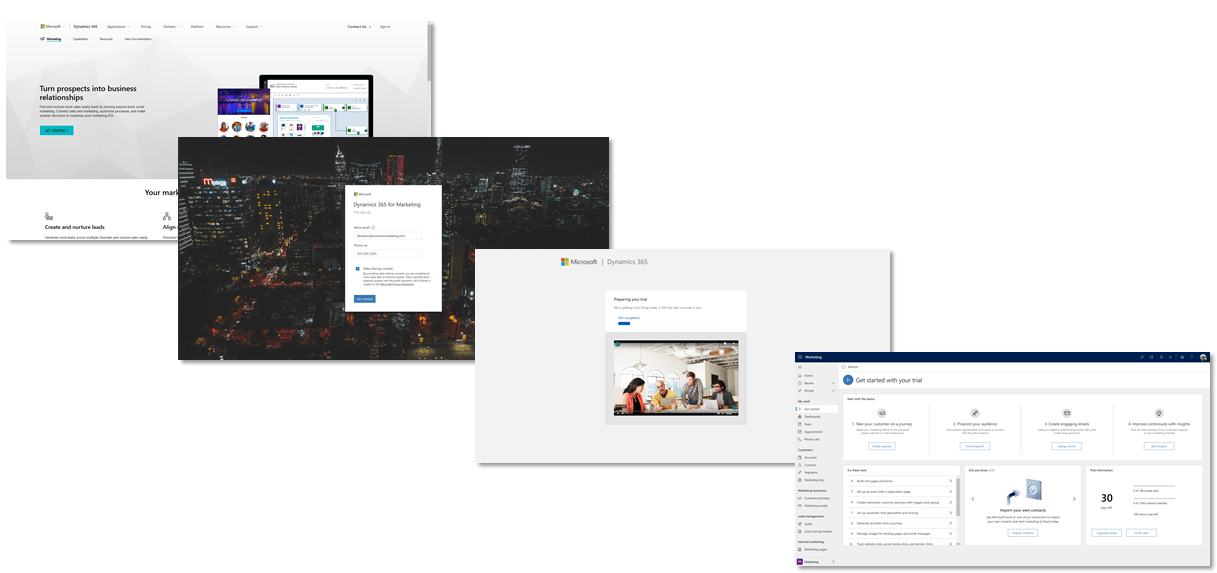

Simplified Sign Up Process Flow Chart

Platform: Generous for Church

Live Date: August 1 2019

Module(s): Mobile App, Text-to-Give

Generous has now updated its mobile and text-to-give sign-up procedure to make the process of giving for first-time users even quicker. With three (3) sets of information needed to get started.

- Provide your name

- Provide your email address

- Provide your credit card / debit account information

The CRA recently introduced a simplified process to allow employees in certain cases to claim home office expenses. About 1/2 of charities in Canada have employees so this will be helpful for them. Also, many volunteers have day jobs and will benefit from this. In short, this simplified procedure will only apply to employees that worked from home at least 50% of the time over a period of 4 consecutive weeks in 2020, it is capped at $400 maximum and it provides $2 deduction for each day the employee worked from home. There is still available the 'detailed' method which may be better for some employees where the employer signs a form.

Here is the announcement that we received from CRA below.

Cue 16 reflections meaning. CUE 16 Reflections. 3/30/2016 0 Comments Ok, I'm going to attempt to finish my reflections from the CUE 16 Palm Springs Convention. This is not easy you see because.

| English version *** La version française suit *** Introducing a simplified process for claiming the home office expenses for Canadians working from home due to the COVID-19 pandemic This year has been filled with unprecedented challenges due to the COVID-19 pandemic. Many Canadians unexpectedly had to work from home which resulted in millions of Canadians setting up their work space in their kitchens, bedrooms and living rooms. In response, the Honourable Diane Lebouthillier, Minister of National Revenue, provided today additional details on how the Canada Revenue Agency (CRA) has made the home office expenses deduction available to more Canadians, and simplified the way employees can claim these expenses on their personal income tax return for the 2020 tax year. Employees with larger claims for home office expenses can still choose to use the existing detailed method to calculate their home office expenses deduction. Employees who worked from home more than 50% of the time over a period of a least four consecutive weeks in 2020 due to COVID-19 will now be eligible to claim the home office expenses deduction for 2020. The use of a shorter qualifying period will ensure that more employees can claim the deduction than would otherwise have been possible under longstanding practice. A new temporary flat rate method will allow eligible employees to claim a deduction of $2 for each day they worked at home in that period, plus any other days they worked from home in 2020 due to COVID-19 up to a maximum of $400. Under this new method, employees will not have to get Form T2200 or Form T2200S completed and signed by their employer. To simplify the process for employees choosing the detailed method, the CRA launched today simplified forms (Form T2200S and Form T777S) and a calculator designed specifically to assist with the calculation of eligible home office expenses. For more information on working from home expenses go to Canada.ca/cra-home-workspace-expenses. Quick Facts

Associated Links Stay connected Balloon in a wastelandspiter games. To receive updates on what is new at the Canada Revenue Agency (CRA), you can:

· Follow the CRA on Twitter – @CanRevAgency. · Follow the CRA on LinkedIn. · Subscribe to a CRA electronic mailing list. · Add our RSS feeds to your feed reader. · Watch our tax-related videos on YouTube. |

Simplified Sign-Up for Generous for Church

Simplified Sign Up Process Flow Chart

Platform: Generous for Church

Live Date: August 1 2019

Module(s): Mobile App, Text-to-Give

Generous has now updated its mobile and text-to-give sign-up procedure to make the process of giving for first-time users even quicker. With three (3) sets of information needed to get started.

- Provide your name

- Provide your email address

- Provide your credit card / debit account information

The system will then allow you to make your first payment.

Simplified Sign Up Process Meaning

Later, when you (the user) have time you can provide more user detail for your Generous user profile.

Simplified Sign Up Process Flowchart

Try simple.